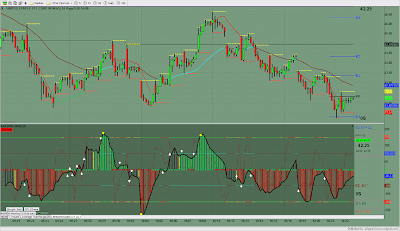

Day Trading LVS after they released their earnings last Wednesday was just a matter of fading the gap opening (46.05) on Thursday and then going long above the Thursday intra day resistance (45.00) on Friday morning. LVS was trading as high as 46.55 before Thursday open. When the opening bell rang and LVS could not take out the pre-market highs, it was just a matter of getting short on the first pullback after taking out the pre-market low of 44.93. My 1st sell short signal came at 9:52 am at 45.06 after trading below thw 44.93 level. The 2nd sell short signal came at 10:08 am at 44.95. The 3rd sell short signal came at 11:10 am at 44.76. The signal to cover the shorts were at 2:47 pm at 44.04. Friday morning after testing the Thursday morning resistance level it was time to go long. That signal came at 9:50 am at 44.90 and we were long on our trading desk....Ka Ching!