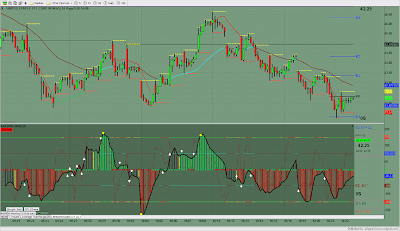

There is nothing more frustrating than trading in a range bound market such as the S&P 500 index whether it be the SPY or the ES futures. I do neither. Instead I trade the EURUSD forex pair which provides me with more trending days than range bound days. I use a 25 pips range bar (see chart) which reduces the noise that time charts are notorious for and gives me just the price action. Friday Dec. 17th was a textbook trending day which provided a clean 171 pips of easy money. The short signal was a swing high at 5:28 am (1.3316) on news of a Moody's downgrade of Ireland. It was time to cover on a swing low in the range bar at S2 support (1.3145) which equates to a 171 pips of profit.